Home is where your story begins.

If you have equity in your home, you may qualify for a revolving line of credit to use for home repairs, renovations, medical bills, paying for college and more.

A Home Equity Line of Credit1 essentially provides homeowners with funds to pay for anything that requires a large amount of money: finishing a basement, remodeling a kitchen or bathroom, installing an addition, building a deck or patio, consolidating high-interest debt and the list goes on and on.

What is a HELOC?

A home equity line of credit, or HELOC for short, allows you to borrow money from the built-up value of your home, also known as equity, using your home as collateral.

Today’s low home equity rates:

7.490% APR1 introductory rate on our variable rate HELOC for the first 3 months then as low as 8.50% APR thereafter. We also offer a fixed rate HELOC as low as 7.490% APR1.

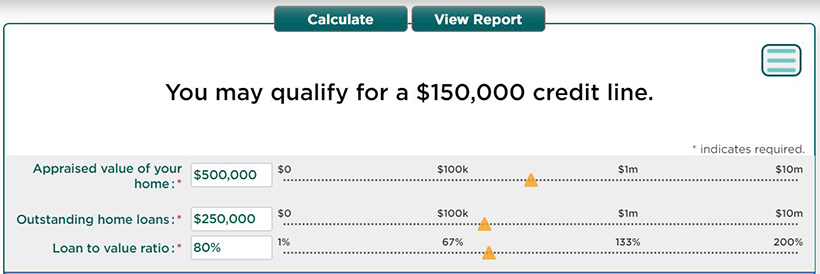

Home equity calculator

Estimate the equity in your home

What’s in it for you?

Low, competitive home equity rates, plus:

- Free consultation to guide applicants through the process

- A full refund on your appraisal (offered through our Premium Bundle discount)

- Low origination fee1

- Easy access to money. You have the flexibility to decide when and how much to use (up to your available credit limit)

- Easy online application (submitting your application takes about 10 minutes)

- You can also apply over the phone by calling 301-933-9100 ext. 104.

Your home equity line of credit made easy

Start online

Submit your secure application online—there’s no fee1 and no obligation, and it only takes about 10 minutes. Start your application now.

Work with one of our HELOC specialists

Signal’s experienced real-estate lending loan officer will help you every step of the way.

Complete the process

Save time and securely complete your application online. If approved, you can enjoy the convenience of closing at a branch of your choice.

After closing on your HELOC, you can easily access your new home equity line of credit and use the funds as you see fit.

FREQUENTLY ASKED QUESTIONS

Is there an application fee?

There is no application fee1.

Is there an annual fee?

Signal Financial does not charge an annual fee1.

Are there closing costs associated with taking out a HELOC?

There are closing costs and fees associated with taking out a HELOC. Our loan officer are here to help you understand the costs and weigh the benefits of taking out a HELOC.

How does using a HELOC compare to using a credit card for my expenses?

While a credit card is beneficial for short term expenses and any applicable rewards, such as cash back or points earned for purchases, HELOC rates are typically lower, which saves you money.

How do I know if I have enough equity?

Our loan officer can perform a quick preliminary assessment based on your existing mortgage and the estimated value of your property. In addition, an appraisal will be conducted to determine the value of your home.

How can I access the money in my Signal Financial HELOC and make a withdrawal?

The money can be easily accessed by transferring funds from your HELOC to any of your Signal checking or savings accounts.

How do I check the balance on my HELOC?

You can check the balance on your HELOC through online banking, in person or over the phone.

How do I make a payment to my Signal Financial HELOC?

We can help you set up automatic payments. You can also make payments online, by mail or in person at one of our six convenient locations.

How does equity build in a home?

Equity is built over time by making monthly payments and reducing the outstanding mortgage balance owed. In addition, increases in value to your home also increase the equity you have built in it.

DISCLOSURES

1 Signal Financial Federal Credit Union Home Equity Line of Credit (HELOC) refers to an owner-occupied primary residence. HELOC products are not available for investment properties. The maximum combined loan-to-value (CLTV) on home equity lines of credit is 90%, which assumes that the total of all existing loans amount does not exceed 90% of the appraised property value. For loans with a CLTV greater than 80%, higher rates will apply. The Annual Percentage Rate (APR) for variable rate loan products may increase in accordance with the Wall Street Journal Prime Rate (“Index”, currently 8.50% as of July 27, 2023), plus a Margin 0.50% after the 7.490% APR introductory rate for the first 3 months has expired. The maximum APR at any time is 18.00%. Rates and offers are in effect for a limited time and subject to change without notice. A minimum initial draw of $10,000 is required on the variable rate HELOC and a minimum initial draw of $100,000 is required for the fixed rate HELOC. Other terms and conditions apply. Closing Cost is estimated to range from $700 to $2,000 depending on the loan amount and the property location. Total closing costs will be at the expense of the borrower. Homeowner’s insurance is required to have sufficient dwelling coverage. An appraisal fee refund is available to members enrolled in a Premium Bundle, with a qualifying mortgage loan. For information about the Premium Bundle, please visit: signalfinancialfcu.org/membership. Credit is subject to approval. Not all applicants will qualify for the lowest rate. Rates and terms are subject to change at any time without notice. Please consult with a loan officer at 301-933-9100 ext. 104 for more information on a Signal Financial Home Equity Line of Credit.

How may we help you?

If you have questions please fill out the form below.