Knowing the “ins” and “outs” of your credit score is crucial to having financial freedom. However, new research shows that one in eight Americans are unaware of their credit score. In a study of 2,000 participants conducted by the marketing research firm OnePoll, it was found that a whopping 71 percent were also unaware of the consequences associated with having a low credit score.

To help increase your own awareness, read through the factors below that, once understood, are game changers when it comes to your credit score.

1. Payment History (accounts for 35% of your credit score)

Consistently making payments has the biggest impact on your score.

Having late and missed payments are the most damaging to your credit score.

If you have a bad track record of paying bills, then you can improve your credit by beginning to pay on time or early.

2. Credit Utilization (30%)

Credit utilization is determined by the amount of credit you’re using compared to the total credit you have available.

The lower your credit utilization, the better your score.

3. Length of Credit History (15%)

A longer credit history gives the credit bureaus a bigger snapshot of your past transactions, which allows them to predict how you will handle your credit and your potential risk.

4. Inquiries & New Credit (10%)

Too many requests to view your credit report also affects your score. However, requests made during a short amount of time may be harmless if you’re doing something like shopping for a car. This varies on a case-by-case basis.

5. Diversification of Credit (10%)

A diverse credit portfolio benefits your credit score since it demonstrates your ability to successfully manage different types of credit.

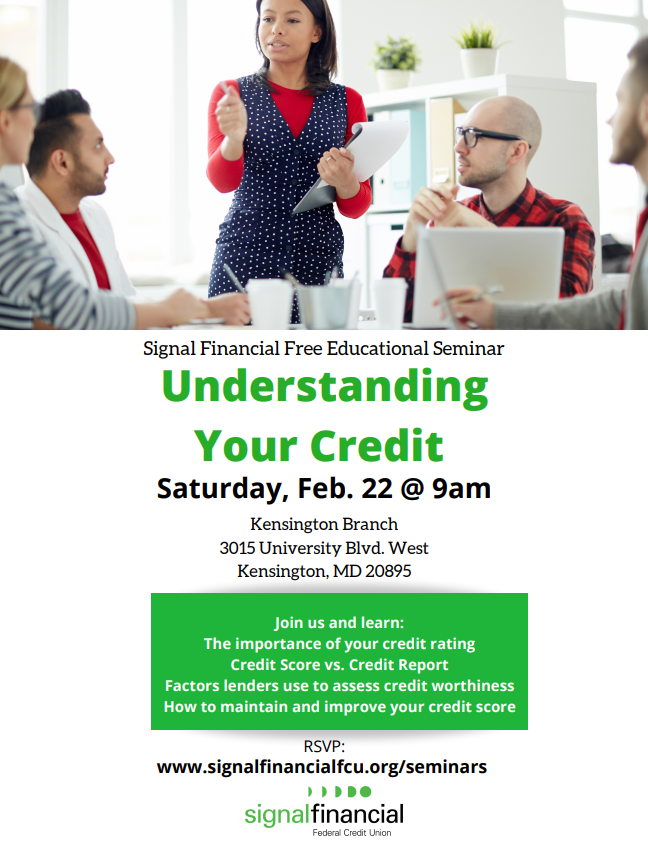

To learn more about your credit, attend our Understanding Your Credit Seminar this Saturday at 9 a.m. at the Kensington branch. Details below.

For regular tips, information and advice on financial empowerment,

follow us on Facebook at: facebook.com/SignalFinancialFCU. We’re also on Twitter and Instagram at: @signalfcu— Written by Leah Dorsey