It might not be a class you take, but one of the most important things you can learn in college is how to manage money.

That’s because many students don’t earn a lot while in school and they have to live off their student loans and money they might make with a job. It’s not easy to do, but it’s a lesson you can fall back on the rest of your life.

Think about the costs: tuition, books, a place to live, utilities, entertainment, and more.

If you’ve never done it before, now is the time to make and follow a budget. How much money will you be spending each month, and how much money do you have? Now, what’s it going to take to keep your financial head above water?

Tuition and a place to live will vary based on where you go to school. If you need to take out student loans, ask yourself if that expensive private school is worth the money you’ll eventually owe or if starting at a lower-price community college might be a better choice. Another thing you should be doing is checking for scholarships and grants that can greatly offset education costs. There are even some employers that will help cover tuition costs.

Then you need to consider a place to live, food, entertainment and other expenses that are sure to pop up.

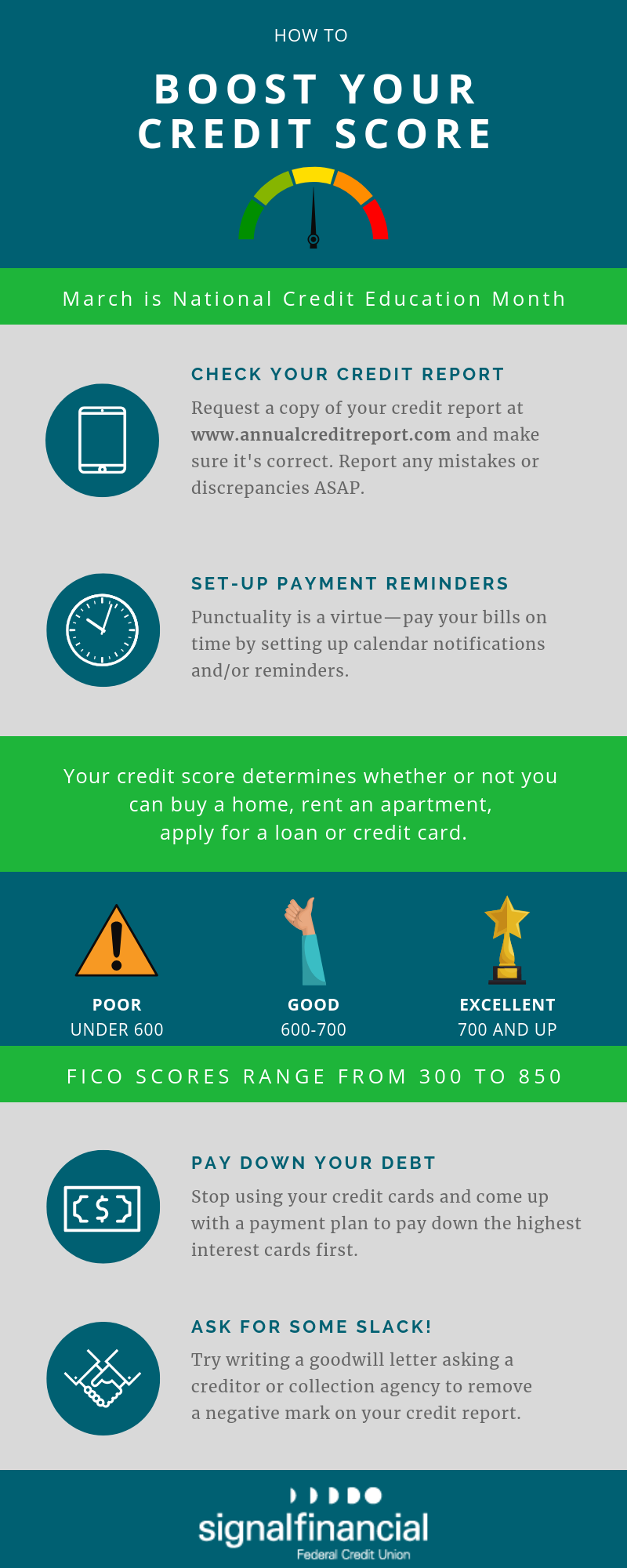

Experts recommend that you open an account at a financial institution and use that to help you keep track of your money. A debit or credit card can be used instead of carrying large amounts of cash, and with cards, you can track where you’re spending your money and how much you have left. Just be sure to spend less than your have and to pay your bills on time.

You should monitor your accounts frequently via a mobile banking app or with your computer and online banking features. You’ll even be able to set up alerts to let you know if balances fall below a certain threshold or if a suspicious transaction occurs.

Learning how to manage your money now will help you avoid overdrafts or late fees and can help you learn the importance of living within your means when funds are tight.

Those are lessons that will pay off in the long run.

This article was originally shared via our education partner, MoneyIQ.