Cannabis Solutions

Our Cannabis solutions and cost-effective fee structure are designed around your unique industry needs, while keeping your costs as low as possible.

Cannabis Membership Savings

| Minimum Balance to Earn Dividends | Dividend Rate | APY4 |

| $0 – $99,999+ | 0.03% | 0.03% |

What’s Included:

Our solutions and cash management services include:

- Debit card(s) for purchases5

- ACH and Wire6

- Online and mobile banking

- Business mobile deposit

- Compliance and transaction reporting via Green Check Verified7

- Cash management services via Empyreal

- Hassle-free ATMs provided by PAI powered by Brinks8

- Payroll & HR services via Green Leaf Business Solutions8

Monthly maintenance fee includes compliance support and transaction reporting through our third-party partner, as well as ongoing management of your accounts by Signal Financial’s team of cannabis banking specialists.

Our Partners

Surrounding ourselves with trusted, recognized industry leaders is what we do best. That’s why we’ve partnered with Green Check Verified and Empyreal Logistics to offer best-in-class solutions for your specific business needs.

Getting Started With Signal

Every cannabis business we serve will be connected with a dedicated Cannabis Banking Specialist to cater to your unique requirements. Your assigned Signal team member will be by your side throughout the entire journey.

Member Perks

We’re committed to helping you and your employees bank easier, bank faster, and bank better. We understand and recognize the cannabis industry as a workforce that deserves smart solutions for your personal banking needs. Whether it’s a high yield savings account, mortgage, or auto loan, Signal Financial has your team covered.

Let’s Connect

Complete the form below and our cannabis banking team will be in touch.

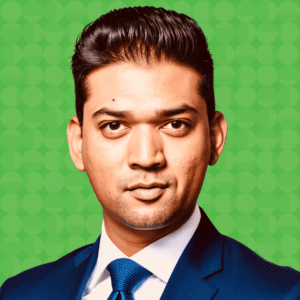

Meet Tausif,

Signal’s Business Development Officer & Cannabis Banking Specialist

Tausif Lodi brings more than 12 years of experience to this growing industry. With a specialized background in business banking, startups, and fintech, his passion lies in supporting small business owners in every aspect of their business. Tausif’s commitment to fostering local business growth led him to join our groundbreaking cannabis banking program, aligning perfectly with his purpose of finding great joy in helping others. His diverse expertise positions him as a valuable asset in driving your success in this rapidly evolving industry.

The Cannabis industry can be complex, so rely on a financial institution with a demonstrated history of expertise.

Place your trust in Signal Financial.

Bank easier, bank faster, and bank better with Signal Financial Federal Credit Union.

Routing Number:

255075495

Main Line

301-933-9100

VISA® Credit Card: General Assistance

For Consumer/Business Cards:

800-328-3018

For Visa Signature Cards:

800-328-3033

VISA® Debit Card: Lost/Stolen

866-498-2213

Automated Phone System

800-447-8997