We make it easier for you to understand the credit score most lenders use

Checking your score regularly is key to understanding credit and building your creditworthiness.

When you apply for credit—such as a credit card, auto loan or mortgage—the company from which you are seeking credit checks your credit report from one or more of the three major consumer reporting agencies. In addition to your credit report(s), they will most likely use a credit score, such as a FICO® Score, in their evaluation of risk before lending their money to you.

When evaluating your credit risk, the items that lenders generally pay the most attention to are:

- Your FICO® Score

- Your payment history — to see if you have paid your bills on time

- Your current debt — to see if you are able to reasonably take on more debt

- Whether you have had any collection accounts

- Any public records, such as bankruptcies, judgments and liens

- The types of financing you have successfully managed

- The length of your credit history

- Recent activity, including new accounts and credit inquiries by other lenders

- Your income — to determine your ability to make required payments

Based on this information, a lender will decide whether to approve or decline your credit application. If they approve it, they will set your credit terms, such as interest rate, credit limit and down payment requirement.

Overview of FICO® Scores

FICO® Scores are one of many factors nearly all lenders in the U.S. consider when they make key credit decisions. Such decisions include whether to approve your credit application, what credit terms to offer you and whether to increase your credit limit once your credit account is established.

FICO® Scores are used by thousands of creditors including the largest lenders, making it the most widely used credit score. Experts estimate that FICO® Scores are used in over 90% of U.S. lending decisions1.

While FICO® Scores are used in 90% of lending decisions, lenders may consider other factors when making credit decisions. Other factors lenders might use include: information you provided on your credit application, how much you earn, your regular expenses, and how you manage your credit, checking and savings accounts.

FICO® Scores can be used in other decisions, too. Your FICO® Scores may be used when you apply for a cell phone account, cable TV and utility services, for example.

How FICO® Scores work

FICO’s research shows that people with a high FICO® Score tend to:

- Make all payments on time each month

- Keep credit card balances low

- Apply for new credit only when needed

- Establish a long credit history

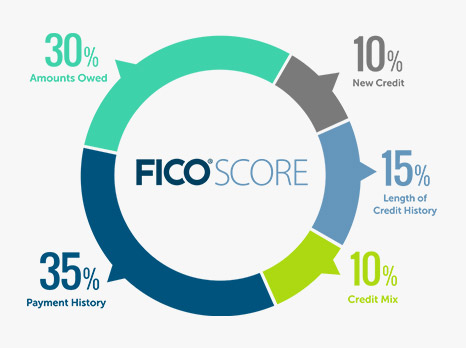

FICO® Scores take into consideration five main categories of information in a credit report: payment history, amounts owed, length of credit history, new credit, and credit mix. The chart below shows the relative importance of each category to FICO® Scores.

TRACKING THE SCORE IS IMPORTANT

FICO® Scores are based on the information in the credit reports at one point in time and can change whenever credit report changes. But a FICO® Score probably won’t change much from one month to the next. However, certain events such as bankruptcy or late payments can lower a FICO® Score fast. That’s why it’s a good idea for consumers to check their FICO® Scores six to twelve months before applying for a big loan, so they can know their FICO® Scores and better understand how FICO® Scores work. For consumers who are actively working to improve their understanding of FICO® Scores, checking their scores quarterly or even monthly is appropriate.

Want to know more?

If you would like more information about how FICO® Scores are calculated and how they can help you obtain credit, read more details at ficoscore.com/info.

Frequently asked Questions

What are FICO® Scores?

FICO® Scores are numbers that summarize your credit risk. Scores are based on a snapshot of your credit file at particular consumer reporting agencies at a particular point in time, and help lenders evaluate your credit risk. FICO® Scores influence the credit that’s available to you and the terms, such as interest rate, that lenders offer you.

How are FICO® Scores calculated?

FICO® Scores are calculated from many different pieces of credit data in your credit report. This data is grouped into five categories as outlined below. The percentages in the chart reflect how important each of the categories is in determining how FICO® Scores are calculated.

30% – Outstanding Debt

15% – Credit History Length

10% – Pursuit of New Credit

10% – Credit Mix

How can I receive my FICO® Score from Signal?

Signal credit cardholders will receive their FICO® Score updated on a quarterly basis, when available.

Will receiving my FICO® Score impact my credit?

No. The FICO® Score we provide to you will not impact your credit.

Why is my FICO® Score not available?

- You are a new account holder and your FICO® Score is not yet available

- Your credit history is too new

- You are not the primary account holder

- You have a business account; this benefit is available only to personal consumer accounts

- Your account does not currently offer this benefit; this benefit is available to credit card accounts only

- Your account is closed or has been inactive for more than 180 days

Whose FICO® Score will appear on the account/statement?

The primary account holder for the credit card. Signal cannot supply scores for any other signers at this time.

Where does the information used to calculate my FICO® Score come from?

FICO® Scores are based on the credit information in a credit file with a particular consumer reporting agency (CRA) at the time the score is calculated. The information in your credit files is supplied by lenders, collection agencies and court records. Not all lenders report to all three major CRAs. The FICO® Score that we provide to you is based on data from your Experian report as of the ‘pulled on date’ shown with your score.

What are Key Score Factors?

When a lender receives a FICO® Score, “key score factors” are also delivered, which explain the top factors from the information in the credit report that affected the score. The order in which FICO® Score factors are listed is important. The first indicates the area that most affected that particular FICO® Score and the second is the next significant area. Knowing these score factors can help you better understand your financial health over time. However, if you already have a high FICO® Score (usually in the mid-700s or higher), score factors are informative but, not as significant since they represent very marginal areas where your score was affected.

Why is my FICO® Score different than other scores I’ve seen?

There are many different credit scores available to consumers and lenders. FICO® Scores are the credit scores used by most lenders, and different lenders may use different versions of FICO® Scores. In addition, FICO® Scores are based on credit file data from a particular consumer reporting agency, so differences in your credit files may create differences in your FICO® Scores. The FICO® Score 5 based on Equifax data that is being made available to you through this program is the specific score that we use to manage your account. When reviewing a score, take note of the score date, consumer reporting agency credit file source, score type, and range for that particular score.

Why do FICO® Scores fluctuate/change?

There are many reasons why a score may change. FICO® Scores are calculated each time they are requested, taking into consideration the information that is in your credit file from a particular consumer reporting agency (CRA) at that time. So, as the information in your credit file at that CRA changes, FICO® Scores can also change. Review your key score factors, which explain what factors from your credit report most affected a score.

Comparing key score factors from the two different time periods can help identify causes for a change in a FICO® Score. Keep in mind that certain events such as late payments or bankruptcy can lower FICO® Scores quickly.

How do I check my credit report?

Because your FICO® Score is based on the information in your credit report, it is important to make sure that the credit report information is accurate. You may get a free copy of your credit report annually. To request a copy of your credit report, please visit: http://www.annualcreditreport.com. Please note that your free credit report will not include your FICO® Score.

Why are you providing FICO® Scores?

Reviewing your FICO® Scores can help you learn how lenders view your credit risk and allow you to better understand your financial health.

More answers to frequently asked questions can be found on the FICO website: http://ficoscore.com/faq/

Additional FICO® Score Information

Frequently Asked Questions About FICO® Scores

Understanding FICO® Scores — SPANISH

Frequently Asked Questions About FICO® Scores — SPANISH

1 CEB TowerGroup (May 2015). Analyst report. © 2015 The Corporate Executive Board Company. All Rights Reserved.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Signal Financial Federal Credit Union and Fair Isaac are not credit repair organizations as defined under federal or state law, including the Credit Repair Organizations Act. Signal Financial Federal Credit Union and Fair Isaac do not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit record, credit history or credit rating.